Skip to: Background | Solution | Results

Skip to: Background | Solution | Results

Precinct Properties is one of New Zealand’s leading owners and managers of premium office space, with landmark buildings including Commercial Bay and the PwC Tower on Auckland’s waterfront. The company owned six properties when it was first listed on the NZ Stock Exchange. Today, that number is 500% bigger – 20 properties with a portfolio value of $3.3 billion, including $431 million in residential.

However, Precinct’s AP function struggled to keep pace with the demands and complexity of the expanding portfolio.

“Invoices were printed, coded by hand, and passed from desk to desk,” recalls Group Financial Controller, Robyn McGregor.

The past four years have been particularly busy for Precinct between joint ventures, portfolio expansions and rebrands.

The manual accounts payable process put pressure on an already-strained three-person AP team.

“We’ve had buildings sell from one entity to another, and people were mixing entity codes with property codes,” says Robyn. “It was happening quite a bit, and with everything still so manual, the risk of errors was high.”

The workload spiked in the lead-up to the monthly payment run, when development invoices, utilities and purchase orders had to be processed – all at the same time.

“It was head down, bum up — just trying to get 1,500-2,000 invoices paid on time,” says Robyn. “Approvers felt like they’d signed things multiple times, while AP staff were stuck chasing invoices that hadn’t made it into the system.”

The business knew AP was one of the biggest and easiest areas to focus on for efficiency. It had previously trialed a data capture solution, but the results were sub-par.

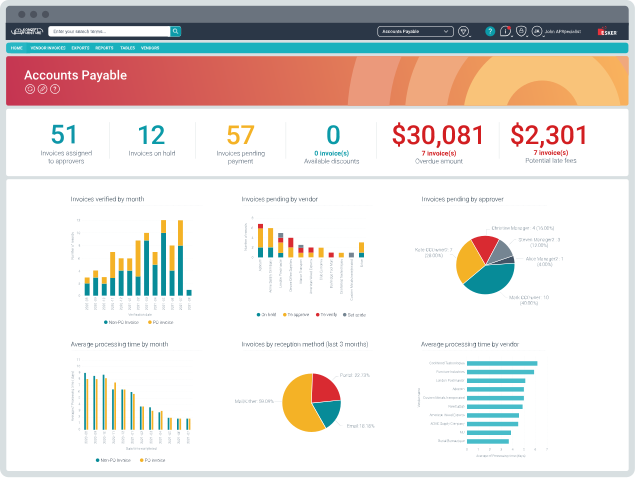

Precinct’s CFO learned more about Esker’s Accounts Payable Platform at a CodeBlue event. The modern, cloud-based platform automates the core tasks of accounts payable, expenses and utilities and is designed to handle complex entity structures.

For implementation, the business partnered with CodeBlue and Fujifilm Process Automation.

Implementation wasn’t without its curveballs, particularly around Precinct’s tiered delegated authority matrix. But Robyn credits the Process Automation team with listening closely and bringing practical solutions to the table.

“We had some whiteboarding sessions to map it out, and together we found a way forward,” she says.

Within weeks of using Esker, the difference was clear.

For the first time, invoices can be tracked, with approvers and AP staff able to see the workflow, comments and supporting documents in one place. Invoices with 50 line items that once took over an hour to process are now handled in seconds using Esker’s clipboard function.

Precinct receives more than 100 utility bills each month. In the past, every invoice was printed, stamped, and coded by hand against a master spreadsheet – a process Robyn admits could consume entire days.

Now, Esker reads the ICP numbers and codes them automatically. This not only reduces workload but also provides ready-made data for sustainability reporting. Instead of analysts chasing providers for usage figures, the information is captured directly from invoices and fed into ESG reporting.

Expense management is simpler, too. Credit card transactions, expense claims and AP invoices now sit in one system. Approvers don’t have to waste time shuffling between spreadsheets and systems, while finance gains access to spend reports that were previously impossible to produce.

But the most significant change has been cultural. With Esker taking care of repetitive processing, the three-person AP team now has the chance to upskill and take on more strategic tasks.

“This is about upskilling,” Robyn says. “We want them thinking about what they’re doing, not just processing. It’s giving them new skills and making their work more valuable.”

In the next phase, Precinct will bring supplier reconciliations into Esker so the AP team can check statements and identify unprocessed invoices before they become payment issues.

From there, the system may integrate with development cost reporting. This will allow AP staff to step into higher-value work, supporting property accountants and taking on coding tasks that once fell outside their remit.

“We’re only six weeks in, but already the feedback is that it’s a lot easier to find and track invoices,” Robyn says.

Approvers and AP team working from one platform where workflows are visible

Credit card transactions and expense claims managed in the same systems as AP

Three-person team redeployed into higher-value work and upskilling for future

Utilities usage taken directly from invoices for ESG reporting

FUJIFILM Process Automation are your local, New Zealand based experts ready to help you on your Esker journey. In fact, we’ve been implementing Esker solutions for Kiwi’s for over a decade now.

AI-Powered processing speeds everything up and it’s smart OCR recognition can even detect and convert handwriting. Fraud protection? Yep, Esker can even detect an invoice with a differing bank account your ERP is expecting, then give your team an alert before it goes any further. That’s just a few reasons why we love Esker, get in touch to hear many more.