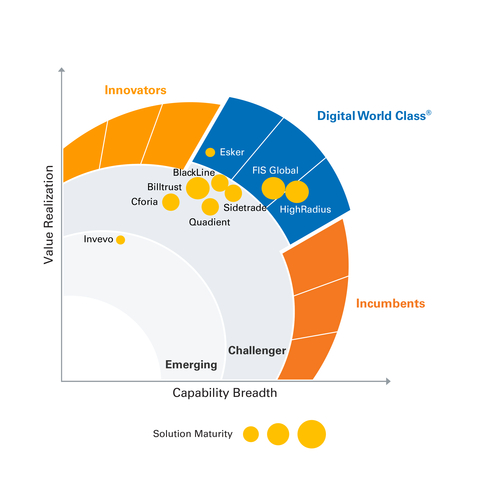

The Hackett Group® Recognises Esker as Digital World Class® Provider in Customer-to-Cash Receivables Creation Software

Modern customer-to-cash (C2C) platforms deliver dramatically superior value realisation compared to legacy applications, including significantly more “hands-free” transaction processing, 10x increased operating cash released from disputed receivables, and huge cash savings for businesses.

The Hackett Group’s C2C Solutions Provider research evaluated nine popular C2C solutions providers based on: C2C performance data in The Hackett Group’s proprietary benchmarking database; analysis of performance data provided by end-users of the C2C solutions; and interviews with solution providers and end-users.