This website uses cookies to analyse our traffic and to ensure you get the best experience. By clicking “Accept”, you agree to our Terms of Use and Cookie Policy.

AI in AP Automation Survey: Key Findings from NZ Finance Leaders

We find out

the use of AI

AP automation levels

invoice processing time

manual entry costs

error handling impact

late payment effects

team productivity loss

future AP plans

How are New Zealand businesses handling Accounts Payable (AP)?

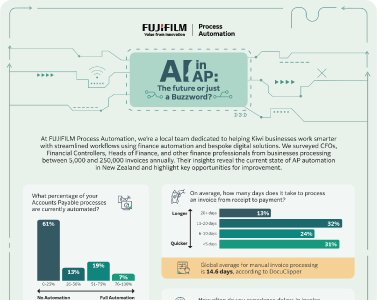

We surveyed CFOs, financial controllers, and heads of finance from businesses processing thousands of invoices each year—ranging from 5,000 to 250,000 annually. Their responses reveal where AP automation stands today, the biggest pain points, and how AI is shaping the future of finance.

Top Insights from the Survey:

Manual AP dominates

Only 7% have full automation.

Processing is slow

Invoices take 10.7 days on average.

Errors are common

46% deal with frequent discrepancies.

AI is underused

Only 21% use AI, but 96% see the benefits.

Download the full survey report for a detailed breakdown of the trends shaping AP automation in New Zealand.

Why This Matters for New Zealand Businesses

Kiwi businesses are facing a growing productivity challenge, with manual processes slowing down finance teams and increasing costs. According to various reports (I’m sure you’ve seen them in the news), NZ lags behind other developed nations in productivity, partly due to outdated workflows and reliance on manual data entry. In accounts payable, this means wasted time on invoice processing, increased errors, and delayed payments—hurting supplier relationships and cash flow.

With rising operational costs and pressure to do more with less, businesses need to find smarter ways to work. AP automation presents a major opportunity to reduce inefficiencies, lower costs, and free up finance teams to focus on strategic tasks rather than chasing invoices. These survey results provide a snapshot of where Kiwi businesses currently stand—and how they can improve.

Why Fujifilm?

- Reduce Operational Cost

- Increase Productivity

- Local Implementation & Support

- Eliminate Errors & Non-Compliance

- Improve Supplier Relationships

- AI-Powered Processing

- Multiple ERP Integration

- eInvoicing & PEPPOL Compliant

At FUJIFILM Process Automation, we’re more than just a provider—we’re local experts in automation, working closely with Kiwi businesses to streamline finance operations. With over a decade of experience implementing AP solutions in New Zealand, we understand the unique challenges businesses face. Our team is based right here, offering hands-on support, custom integrations, and expertise across Esker, Microsoft, DocuSign, and more.

Get in touch to see how AP automation can transform your finance team.